What are the important factors to consider when appraising a business?

Thinking of selling your business? Not sure where to start? How do I know what my business is worth?

As a business owner I am sure you have thought of, if not asked these very important questions at one point in time. It is not the intention of this article to discuss preparing your business for sale, or to convince you the best way forward is to appoint a business broker to act for you, although these are two very significant parts of the puzzle in extracting the full value of your business at a sale. This article means to give you an idea of several factors surrounding your business which will add to its current value. Some of these points you can control, others you cannot, but let’s look at them individually to give you an understanding of what they are, and why they are important.

* Location / Position – yes we have all heard this, Location, location, location. It is the most commonly used sales pitch in real estate. But what does that mean for your business? Firstly, a high traffic, high visibility, highly sought after location with successful businesses and tightly held leases in the area can add significant value to your resale. Consider the availability of parking, access to signage, entrances and exits, and don’t forget that the location in and of itself will not guarantee success.

* Financial records – the integrity of tax returns, profit and loss statements, BAS reports and the like are very important in determining a value for your business. Businesses who can show complete and accurate records with strong business and income growth will demand a higher sale price.

* The Lease – How friendly is your lease? What is the monthly rent? Is it a fair expense per square meter compared to other properties in the area? How long is the rental bond (I have seen some landlords asking 12 months in advance)? Do you have any rental options for further terms? Is there a percentage rent clause or a demolition clause? These points are hugely significant when it comes to finding a buyer for your business and having them pay top dollar for it.

*Is it a Franchise? if so, what are the exit costs involved and who pays them. I have seen some exorbitant exits fees associated with selling franchises and at the end of the day, they reduce the value of the business significantly. Moreover, they restrict the amount of genuine buyers in the market place because, although they are buyers at the moment, they will also have an exit strategy which means at some point in the future they will want to sell. Make sure as a business owner and franchisee that you are aware of what costs are involved in exiting your franchise.

* Plant, equipment and fixtures – How old are they? Do they work? Are they clean and in good condition? Are they leased or owned? If a buyer has to inject significant capital over and above the purchase of the business to upgrade or install expensive operating equipment, then you can be assured this will lessen the price they will offer you for your business.

* Trading hours – How long is your business open for? The difference in resale value between businesses who are open for less days and hours than another is very significant. For example, a 5 day CBD café will usually be able to achieve a 2 to 2.5 times EBITDA where an equivalent business trading 7 days is around 1 to 1.5 ! The less hours the business trades for makes it more profitable on a weekly / monthly basis.

* Business Operation – is the business clean, well stocked, adequately staffed? These points alone can determine whether a buyer will proceed with the transaction. A clear sign that a business is struggling is one where staff numbers are reduced (this places extra stress on the staff who are working) stock levels are inadequate with half empty fridges and missing menu items, and a dirty run down establishment. Keep on top of these things so that customers and buyers don’t think there are issues with your business. Can the business be converted into a more suitable concept, maybe a different cuisine or franchise more suited to the area? Does it have a liquor license in place and a food registration permit? Buyers look for location and unprofitable businesses simply to acquire the location and convert it.

* Reputation – the easiest way to get an idea of how a business is performing these days is to jump online and read the reviews. Social media is a huge part of businesses these days and it extends far beyond whether the owner has the business online or not. There are many websites which allow users to rate and review a business and this quickly unfolds to become part of the businesses reputation, whether you like it or not! An online presence, including a website, businesses reviews and write ups, along with special awards and recognition can all assist with adding significant value to the resale of your business.

*Reason for Sale – as a business broker, I get asked this question everyday on most of my businesses. In reality, it doesn’t matter, but buyers ask and they want to know. It goes along way to addressing their concerns and apprehension about the business. Within reason, I think it is better to tell them so they feel comfortable enough to proceed. As a business owner, you will most likely be asked this at a face to face meeting so be prepared to respond honestly and promptly.

*Potential – can the business grow? It’s hard to sell potential, many if not all business owners tell me how good the location “could” be, and their points are very relevant and I never dismiss them. These issues can attract buyers who are looking for ways to grow a business, add catering, capitalize on the nearby schools, industry and homes. Preparing a solid and credible growth strategy can assist with selling and achieving the best possible sale price.

There are many issues which arise when it comes to appraising businesses, these are just a few of them. Each point can significantly increase, or reduce the selling price of your business. It is best to meet with your broker and undertake a thorough discussion about selling your business. Be mindful that people involved in the selling process don’t just tell you what you want to hear, only to have you let down months later by a significantly less sale price. The business broker isn’t buying your business, someone else is!

For a no obligation discussion about selling your business please feel free to contact Brian BUDD at TRIDENT Business & Corporate Sales on 03 98687 2116 or 0417 303 196.

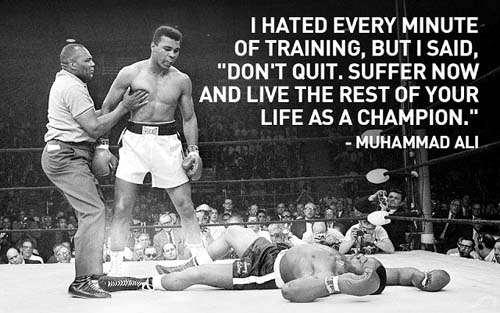

They understand that complaining doesn’t make the situation better.

They know that people won’t treat them the way they want to be treated, circumstances might not be ideal, and they will experience adversity; however, rather than complain about the negative aspects of their situation, they focus on what they want to happen and what they’re going to do about it.

They are not people pleasers.

They are relentless in their pursuit of their passion and aren’t worried about what other people think.

They give power to what they focus on, and if they waste their time focusing on the opinions of others, they lose sight of the things that will make them truly successful.

They are always looking for ways to evolve. They believe that if they continue to give their best, their best will continue to get better over time.

With the competition continuing to get bigger, stronger, faster, and smarter; it’s important to have the mindset to improve by learning from successes and failures.

The mentally tough swing for the fences and know that it might mean striking out a few times (or many times). Their purpose for achieving greatness casts away their fear of failure. They refuse to tip-toe through life, they intend on creating a legacy for the future by making an impact in the here-and-now.

They refuse to waste time focusing on things they can’t control because there is nothing they can do about it!

They understand that the less control a person feels the more susceptible they are to making poor decisions, falling into bad habits, and crumbling under pressure.

Original article posted on addicted2success.com by Justin SU’A

Business Broker

Business Brokerage is an extremely important link in the Australian entrepreneurial chain. Eden Exchange recently spoke with Brian Budd who is the founder and principle broker at Trident Business and Corporate Sales, one of Melbourne’s leading business brokers.